Just How Livestock Risk Security (LRP) Insurance Coverage Can Protect Your Animals Investment

In the realm of livestock financial investments, mitigating dangers is vital to ensuring monetary stability and growth. Animals Threat Protection (LRP) insurance policy stands as a reputable guard against the uncertain nature of the marketplace, providing a strategic approach to protecting your possessions. By diving right into the complexities of LRP insurance coverage and its multifaceted benefits, animals producers can fortify their investments with a layer of security that goes beyond market changes. As we explore the world of LRP insurance, its function in securing livestock financial investments ends up being increasingly noticeable, assuring a path towards sustainable economic durability in an unstable sector.

Understanding Animals Danger Security (LRP) Insurance Policy

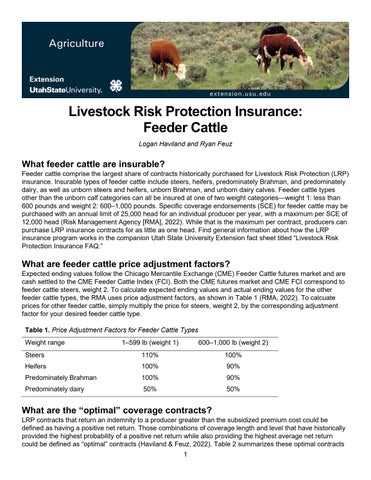

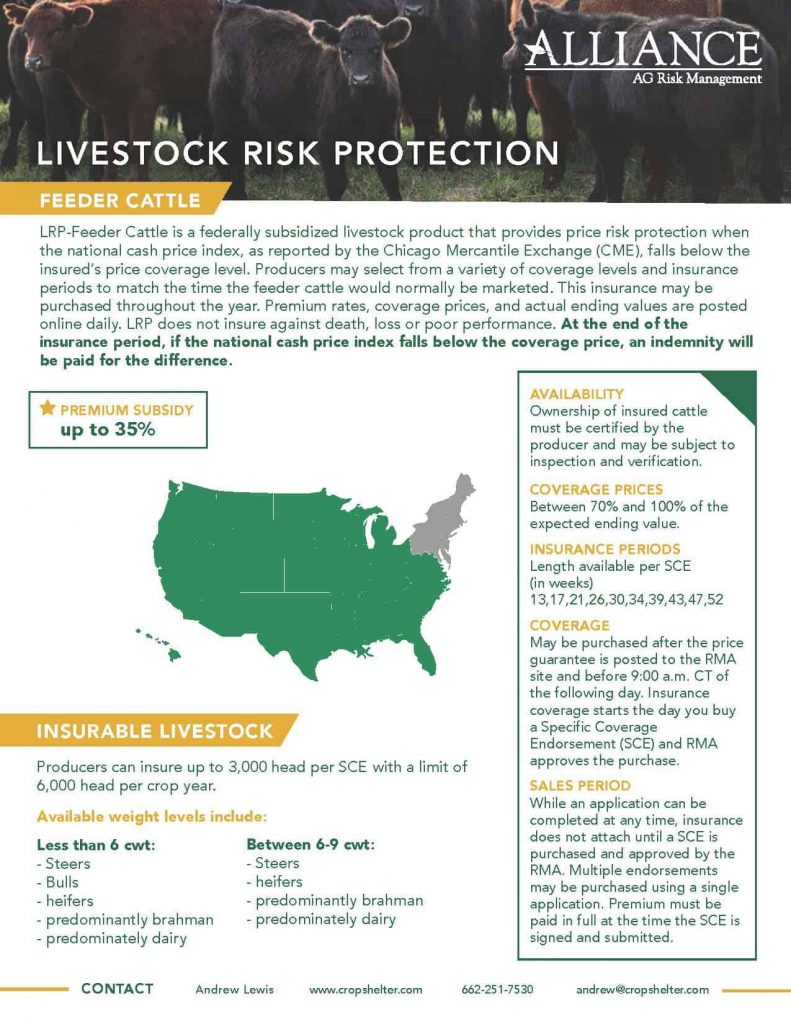

Comprehending Animals Risk Security (LRP) Insurance coverage is necessary for animals producers aiming to alleviate economic risks linked with rate fluctuations. LRP is a federally subsidized insurance policy item developed to protect manufacturers against a drop in market prices. By giving coverage for market cost decreases, LRP helps producers lock in a floor price for their animals, ensuring a minimum degree of income no matter market variations.

One key aspect of LRP is its adaptability, allowing producers to customize protection levels and policy lengths to match their details requirements. Producers can pick the number of head, weight range, protection cost, and protection period that straighten with their manufacturing goals and run the risk of resistance. Comprehending these adjustable alternatives is essential for producers to efficiently handle their cost danger direct exposure.

Moreover, LRP is available for different livestock kinds, including livestock, swine, and lamb, making it a functional risk monitoring device for animals manufacturers across different industries. Bagley Risk Management. By familiarizing themselves with the details of LRP, manufacturers can make enlightened choices to guard their investments and make sure economic security when faced with market unpredictabilities

Advantages of LRP Insurance for Livestock Producers

Animals manufacturers leveraging Livestock Risk Defense (LRP) Insurance acquire a tactical advantage in shielding their financial investments from price volatility and protecting a secure monetary ground amidst market uncertainties. By setting a floor on the price of their animals, producers can alleviate the threat of significant economic losses in the event of market slumps.

Moreover, LRP Insurance offers manufacturers with peace of mind. Recognizing that their financial investments are guarded versus unforeseen market modifications allows producers to focus on various other elements of their organization, such as improving pet health and well-being or optimizing manufacturing processes. This satisfaction can result in boosted performance and profitability over time, as producers can operate with more confidence and security. Overall, the advantages of LRP Insurance policy for livestock producers are considerable, supplying a valuable tool for taking care of danger and making sure economic protection in an unpredictable market setting.

How LRP Insurance Mitigates Market Dangers

Minimizing market risks, Animals Risk Defense (LRP) Insurance gives animals producers with a reputable shield versus rate volatility and economic uncertainties. By offering protection versus unanticipated price declines, LRP Insurance policy assists manufacturers secure their investments and maintain financial stability in the face of market changes. This sort of insurance policy allows livestock manufacturers to lock in a price for helpful site their animals at the beginning of the plan period, ensuring a minimum price level no matter market modifications.

Steps to Secure Your Animals Investment With LRP

In the world of agricultural threat administration, implementing Livestock Risk Security (LRP) Insurance coverage involves a calculated process to safeguard investments against market changes and uncertainties. To safeguard your livestock financial investment effectively with LRP, the first action is to assess the details dangers your operation faces, such as rate volatility or unanticipated climate occasions. Next, it is important to research and select a respectable insurance provider that offers LRP plans customized to your livestock and organization requirements.

Long-Term Financial Security With LRP Insurance

Guaranteeing enduring economic stability through the use of Livestock Risk Defense (LRP) Insurance coverage is a prudent lasting technique for agricultural manufacturers. By including LRP Insurance into their danger monitoring strategies, farmers can secure their livestock investments against unanticipated market changes and negative occasions that might endanger their monetary well-being with time.

One trick advantage of LRP Insurance policy for long-term financial protection is the satisfaction it uses. you can check here With a trustworthy insurance coverage policy in area, farmers can alleviate the monetary risks connected with unstable market conditions and unforeseen losses as a result of variables such as illness episodes or natural catastrophes - Bagley Risk Management. This stability enables producers to concentrate on the day-to-day procedures of their livestock organization without consistent stress over possible financial troubles

Furthermore, LRP Insurance coverage gives a structured method to handling threat over the long-term. By establishing particular coverage degrees and choosing appropriate recommendation durations, farmers can tailor their insurance plans to straighten with their financial objectives and risk tolerance, making sure a protected and sustainable future for their livestock procedures. To conclude, purchasing LRP Insurance coverage is an aggressive technique for farming producers to attain lasting financial safety and shield their incomes.

Verdict

Finally, Animals Risk Protection (LRP) Insurance coverage is a useful tool for animals manufacturers to alleviate market dangers and protect their financial investments. By comprehending the benefits of LRP insurance policy and taking actions to apply it, manufacturers can accomplish lasting economic safety for their operations. LRP insurance offers a safeguard versus price fluctuations and makes sure a degree of stability in an unforeseeable market atmosphere. It is a wise choice visit their website for guarding animals investments.